Fridays After 5 Featuring Marsha

Fridays After 5 Featuring Marsha

Witherspoon

SDA’s member spotlight Fridays After 5 showcases the varied creative, fun, adventurous, or exciting achievements our members accomplish after business hours.

Just in time for tax season, meet two-time SDA National Treasurer Marsha Witherspoon, CDFA. Marsha knows a thing or two about dollars and taxes. She was a banker for over 30 years before moving to the A/E/C industry. After 20 years with Cole & Denny Architects in Alexandria, Virginia, she retired and relocated to Ohio.

A not-too-taxing project.

For the last seven years, Marsha has volunteered with the AARP Foundation Tax-Aide program. The Tax-Aide program helps low-income Americans over 50 years old file their taxes. Assistance may be in person, low contact, contact free or self-prepared. The tax assistance is free of charge and you do not have to be a member of AARP to access the services.

Specific training is required to volunteer. The IRS and program providers both offer training. Experienced volunteers can take classes in-person, or they can take an online refresher course. After completing the training, volunteers must pass the Volunteer Standards of Conduct Certification before working at a site. Returning volunteers must certify themselves on an Intake/Interview and Quality Review Form and tax law before signing the appropriate forms to return as a volunteer. Credentials must also be approved by a site coordinator, sponsoring partner, instructor, or IRS contact before you can prepare tax returns for others.

There are challenges with this type of volunteer activity. As Marsha explains, “volunteers can only prepare tax returns for the years in which they are certified to prepare the return. If a client has not filed a tax return for several years and one of those years is one for which she is not certified, she cannot file the return. Clients may become unhappy if they have to wait for a volunteer certified for that year or even come back another time. Also, in the not-so-fun column, is telling clients they will not be getting a refund or that additional taxes are due.”

There are challenges with this type of volunteer activity. As Marsha explains, “volunteers can only prepare tax returns for the years in which they are certified to prepare the return. If a client has not filed a tax return for several years and one of those years is one for which she is not certified, she cannot file the return. Clients may become unhappy if they have to wait for a volunteer certified for that year or even come back another time. Also, in the not-so-fun column, is telling clients they will not be getting a refund or that additional taxes are due.”

The difference Marsha makes in the lives of others is what Marsha finds most rewarding about volunteering. As Marsha describes, “It makes me feel good that the skills I possess can be of benefit to someone else. When their tax return is completed, the joy on a client’s face is priceless, especially if they will get a refund, no matter how large or small. It is gratifying when a client specifically requests that I be the volunteer that prepares their return each year.”

Advice for the tax-averse.

Forosophobia, the fear of taxes, plagues many people, including me. For us, Marsha has this idea: “A suggestion I’ve made to family and friends is that they immediately set up a file for the following year’s tax return once they have filed the current return. Drop all the data, receipts, pay stubs, etc., you think will be needed to file your next return in that folder. At least when it’s tax time again, most of your information should be in that one file, and you don’t lose a lot of time trying to gather what you need to do your return.”

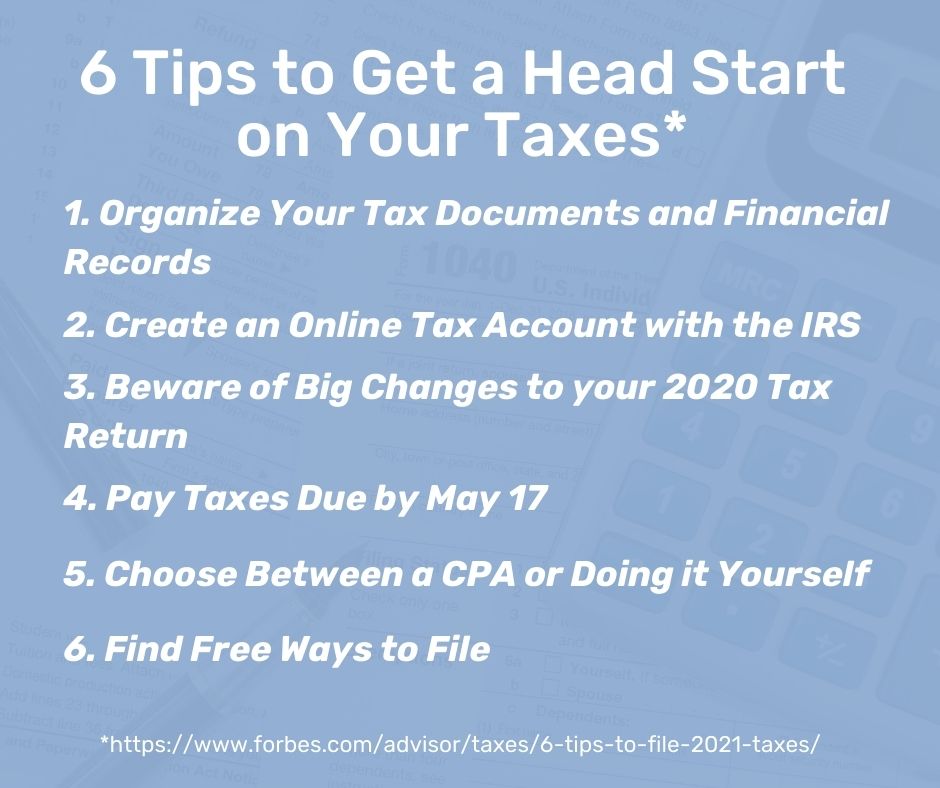

Marsha shared this Forbes article that she says has some good advice to prepare for tax season. Lucky for many of us is that Congress recently extended the tax filing deadline for individual tax returns to May 17, 2021.

Besides volunteering with Tax-Aide, Marsha enjoys walking, reading, crossword puzzles, word searches, and other word games. Currently, her favorite word game is the New York Times Spelling Bee. She and her hubby look forward to more face time with their six children, 11 grandchildren, and three great-grandchildren.

Posted Monday, April 26, 2021